The Bike to Work Scheme

Save up to 52% on any bike

The Bike to Work Scheme is a Government run scheme to incentivise cycling and commuting to work.

The Cycle to Work Scheme, also known as the Bike to Work Scheme, is a program initiated by the government to encourage people to commute to work by cycling. The scheme offers a financial incentive for individuals to purchase a bicycle and related accessories.

By participating in the scheme, you can save up to 52% on the cost of a new bike. The scheme works by allowing employers to provide employees with a tax-free loan to purchase a bicycle and accessories up to a certain value. The employee then pays back the loan through salary deductions over a set period of time. By promoting cycling as an alternative means of commuting, the scheme aims to reduce traffic congestion and air pollution while promoting a healthy lifestyle.

€3,000

Cargo & E-cargo Bikes

€1,500

Pedelecs & E-bikes

€1,250

All Other Bikes

Everything you need to know

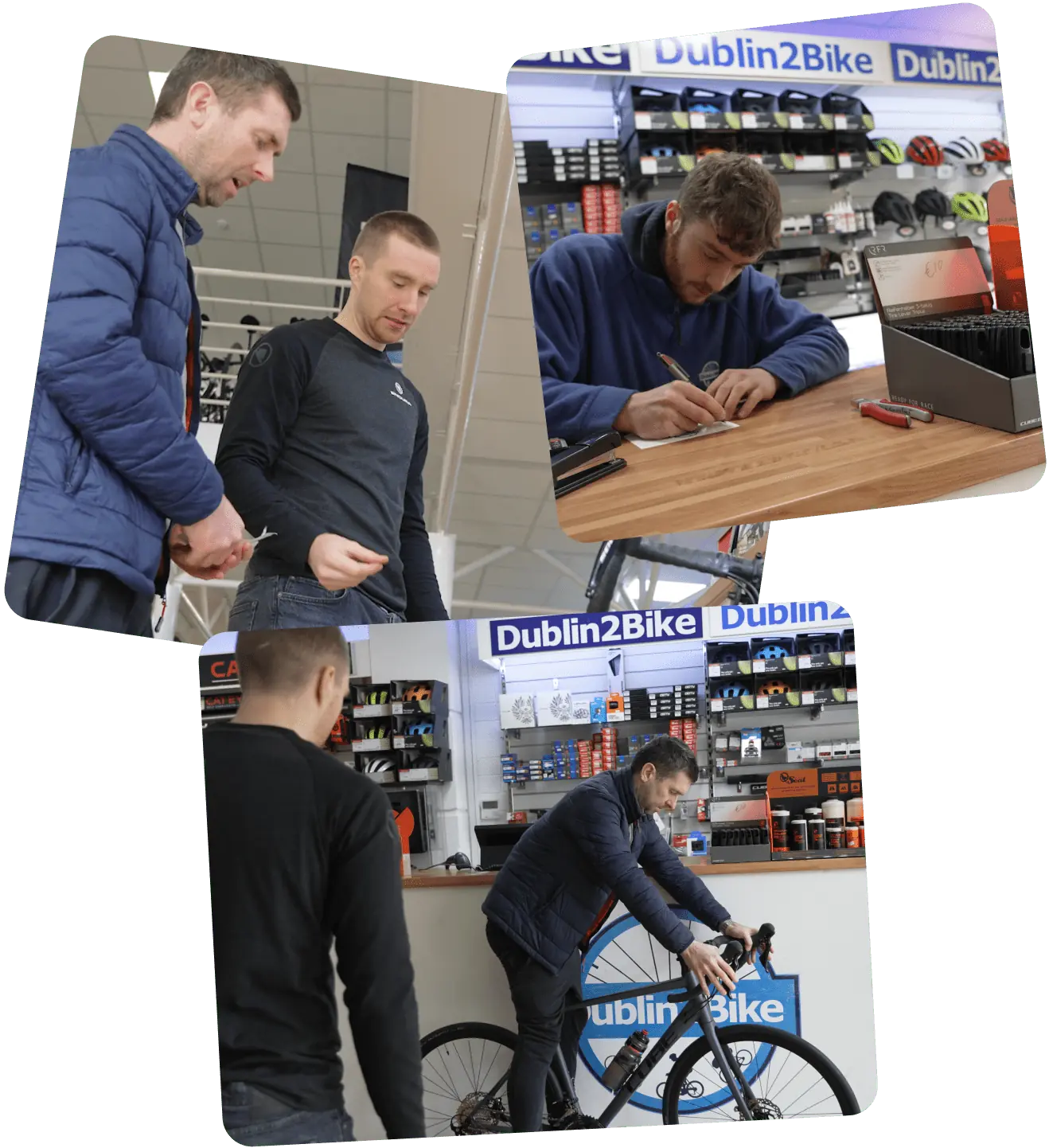

Call in to our shop and with the help of our staff choose the bike that is right for you.

We will then send you a Bike to Work Scheme quote to your email

You must then send this quote or invoice to your employer and they will pay for the bike on your behalf

This then goes through payroll minus the tax (saving) and you can choose your repayments - 1 months, 3months, 6 months, 12 months.

You will save your tax rate so between 31% and 52%

Your employer does not have to take part in the scheme.

"The Bike to Work Scheme has been a great investment for me. By purchasing a new bike and accessories at a reduced cost, I have been able to avoid traffic and stay healthy by cycling to work. The scheme is a great way to save money and reduce one's carbon footprint. I highly recommend the Bike to Work Scheme to anyone who wants to make a positive impact on their health."

View all

FAQs

Find out more

Can’t find the information you’re looking for? Let us know by contacting us and we will help you with your scheme application. Our customer support is available Monday to Friday: 9am-5:30pm.

Q: What is the Bike to Work Scheme?

A: The Bike to Work Scheme is a government initiative that allows employees to purchase bicycles and cycling equipment tax-free through their employer. The aim of the scheme is to encourage more people to cycle to work, promoting a healthier and more sustainable way of commuting.

Q: How does the Bike to Work Scheme work?

A: The Bike to Work Scheme allows employees to purchase a bicycle and cycling equipment up to a maximum value of €1,500 tax-free through their employer. The cost of the bicycle and equipment is then deducted from the employee's gross salary over a period of up to 12 months, resulting in a potential saving of up to 52% on the total cost.

Q: Who is eligible for the Bike to Work Scheme?

A: The Bike to Work Scheme is available to all employees who are paying income tax through the PAYE system, regardless of their income level. However, it's important to check with your employer to ensure they participate in the scheme.

Q: What kind of bicycles can I purchase through the Bike to Work Scheme?

A: The Bike to Work Scheme allows for the purchase of bicycles and cycling equipment that are primarily used for commuting to and from work. This includes road bikes, commuter bikes, hybrid bikes, e-bikes, and related accessories such as helmets, locks, and lights.

Q: How do I apply for the Bike to Work Scheme?

A: To apply for the Bike to Work Scheme, you should first check with your employer to ensure they participate in the scheme. Once confirmed, you can choose a bicycle and equipment from an approved supplier and your employer will deduct the cost from your gross salary over the agreed period.

Q: Can I purchase a bicycle for someone else through the Bike to Work Scheme?

A: No, the Bike to Work Scheme is only available to employees who will be using the bicycle and equipment for commuting to and from work. The scheme does not allow for the purchase of bicycles or equipment for family members or friends.

Q: What happens if I leave my job before the end of the agreed payment period?

A: If you leave your job before the end of the agreed payment period, you will be required to pay the remaining balance on the bicycle and equipment directly to your employer. However, some employers may allow you to continue making payments even if you are no longer employed by them.